Eligibility requirements to apply for Koho credit card Canada

☑️ Be at least 18 years old and reside in Canada

☑️ Have a valid Canadian address and phone number

☑️ Open a Koho account via app or website

☑️ Have Apple Pay, Google Pay, or Samsung Pay enabled for payments

Documents and information required

📄 A valid government-issued photo ID (passport, driver’s license, or similar)

📄 Canadian address for account setup

📄 Personal identification details for verification

📄 Email address and mobile number for account activation

Approval depends on meeting these requirements. Koho may ask for additional information if needed.

How to apply for Koho credit card Canada?

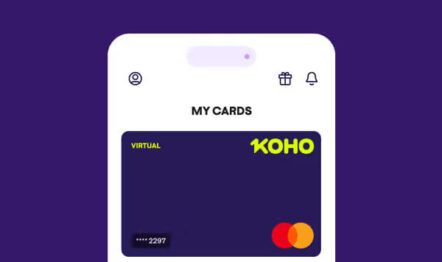

Applying for the Koho credit card Canada is quick and entirely online. You simply download the Koho app or visit their website, choose a plan that fits your needs, and create your account. Once the account is set up and funded, you’ll have immediate access to your virtual card.

Through the app, you can easily add it to Apple Pay, Google Pay, or Samsung Pay and start using it for purchases in stores or online. Because there are no credit checks involved, approval is instant as long as you meet the basic criteria. If the request is not approved right away, Koho allows you to try again later, depending on their internal review process.

How to pay monthly bills for Koho credit card Canada?

Since Koho credit card Canada is a prepaid product, there are no revolving credit bills. Instead, you need to ensure your account has enough balance to cover your purchases and subscriptions. Adding funds is simple through Interac e-Transfer, direct deposits, or cash at Canada Post locations.

Payments for subscriptions or recurring charges will automatically deduct from your balance, so it’s important to monitor available funds through the app. There’s no minimum monthly payment or interest — you just spend what you load.

Taxes and fees

Although Koho credit card Canada doesn’t charge annual fees, interest rates, or penalties for late payments (since it’s prepaid), some costs may apply depending on how you use the account. For instance, cash deposits at Canada Post may incur a small service fee, and premium Koho plans, which offer higher cashback rates or extra benefits, come with a monthly fee.

There are no overdraft fees because you can’t spend beyond your balance. However, users should always monitor transactions to avoid failed payments for subscriptions if the balance is too low. All fees are clearly listed inside the Koho app, and users are notified before any charges apply.

A tip for your wallet

One of the smartest ways to use Koho credit card Canada is by setting up a recurring “loading schedule” to make sure you always have funds available for regular expenses like subscriptions, groceries, or transportation.

Since Koho offers cashback on selected purchases, concentrating your spending on those categories can maximize your benefits. Also, use the instant lock/unlock feature whenever you’re not using the card — an added layer of security that prevents fraud. Another overlooked advantage is reducing plastic waste, as everything happens digitally — so if you’re looking for a practical and eco-friendly solution, this is a plus.

Ready to get your card?

Want to see all the details and apply for Koho credit card Canada now? Click below to access the official site and start your application today! The Koho credit card Canada is a smart way to manage your finances, and we’ll help you get started.