Am I eligible to apply for the Fig Loan?

Understanding how to apply for the fig loan starts with knowing who is eligible. The Fig Loan is designed for individuals looking for a fair and accessible personal loan. Applicants must reside in Canada and meet the age-of-majority requirement for their province. A stable source of income is required to demonstrate the ability to repay the loan under the proposed terms.

While credit history is considered, Fig uses a holistic evaluation that looks at multiple financial factors. Applicants cannot have an active Fig Loan at the moment of applying, and those who were declined within the past 30 days must wait before trying again.

Due to regulatory restrictions, residents of certain northern territories are not eligible. Overall, learning how to apply for the fig loan helps borrowers understand whether this responsible lending option fits their situation.

Required documentation

A key part of how to apply for the fig loan is preparing the required documentation. To apply, you must provide identification that verifies both your identity and your residency. This may include a government-issued photo ID, proof of address, and basic personal information.

Fig may also request proof of income, such as pay stubs, bank statements, or employment verification, depending on your financial profile. In some cases, additional documents are needed to better understand your ability to repay the loan.

All information is processed using secure, bank-level technology. Having everything ready makes how to apply for the fig loan much faster and smoother and remember to borrow only what you truly need to protect your financial well-being, and review your monthly expenses to select the best repayment schedule.

A helpful tip before you learn how to apply for the Fig Loan!

Before moving forward with how to apply for the fig loan, it’s smart to check your rate first. This step does not affect your credit score and gives you a clear idea of your options before committing. Compare different loan amounts and repayment terms to choose what fits your budget comfortably.

Many insights into how Canadians use credit come from the Canadian Financial Capability Survey (CFCS), conducted by Statistics Canada. According to the survey, approximately 73% of Canadians used some form of borrowing or credit in the year analyzed, showing how common personal loans, credit cards, lines of credit, and other financing tools are across the population.

The CFCS also highlights Canadians’ financial behaviours, challenges, and confidence when managing debt, reinforcing the importance of responsible borrowing solutions. This makes the Fig Loan particularly relevant for individuals seeking safe, structured, and transparent financial support.

Here’s how to apply for the Fig Loan!

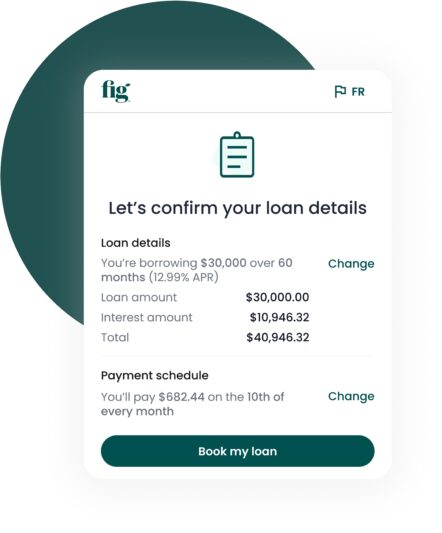

If you’re ready to begin, here’s how to apply for the fig loan in just a few minutes. Start by clicking the button below to check your personalized rate—this step will not impact your credit score. Then you can customize your loan amount, choose your repayment terms, and complete a quick verification process.

Everything is digital, secure, and easy to navigate.

Once approved, your funds may be deposited as soon as the next business day. If you want a simple, fast, and transparent process, now you know how to apply for the fig loan—click the button and start your application.