Understanding the main benefits of the Lending Mate loan and who can apply!

When learning about the main benefits of the Lending Mate loan, it’s important to first understand who can apply. Anyone living in Ontario or British Columbia is eligible as long as they are over the age of majority and able to provide a reliable guarantor.

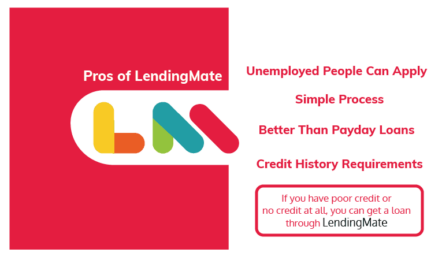

Borrowers do not need a credit score or employment history, which is one of the main benefits of the Lending Mate loan, making it highly accessible. The guarantor must meet financial and stability requirements, ensuring safety for both parties. Applicants also need a valid Canadian bank account to receive funding and complete verification.

Individuals with low credit, new-to-credit backgrounds, or past financial difficulties often find this product ideal. As long as the guarantor is approved, most applicants receive acceptance, demonstrated by the company’s 95% approval rate, another one of the main benefits of the Lending Mate loan, reinforcing why it is considered one of the most accessible loan options in Canada.

Required documentation

To begin accessing the main benefits of the Lending Mate loan, both you and your guarantor must provide basic verification documents. This includes government-issued identification, proof of residence, and access to an active Canadian bank account.

You may also need to confirm personal information such as date of birth, contact details, and general financial status.The guarantor will be asked for proof of income or financial stability to ensure they qualify to support the loan.

Banking details are also needed to set up payments and disburse funds safely. One of the main benefits of the Lending Mate loanis that the documentation process is streamlined, avoiding unnecessary paperwork and keeping the application fast and accessible.

Words of advice!

Before applying, have an open conversation with your guarantor about shared responsibilities. Since both parties are equally accountable, choosing someone who trusts you is crucial. Reviewing your repayment plan together can also help you both feel secure.

TransUnion Canada’s Consumer Credit Market Report reveals a clear upward trend in borrowing behaviour nationwide. In 2024, total consumer debt reached over $2.5 trillion, representing a 4.5% year-over-year increase, driven in part by higher usage of non-mortgage credit such as personal loans and lines of credit.

The report also notes changing repayment habits and rising demand for alternative, more flexible financing options. This data demonstrates how products like the Lending Mate Loan can help Canadians manage expenses, consolidate debt, and gain greater control of their financial situation in a secure and predictable way.

Start experiencing the main benefits of the Lending Mate Loan!

If you’re ready to experience the main benefits of the Lending Mate loan, click the button below to start your application. Begin by entering your personal details and selecting the amount you wish to borrow. Then, invite your guarantor to submit their information for review.

After both steps are completed, the Lending Mate team will assess your application and deliver a fast decision. If approved, funds may be deposited in as little as 24 hours, one of the most appreciated main benefits of the Lending Mate loan. The entire process is digital, secure, and designed to reduce stress. Click below to get started and move one step closer to reaching your financial goals.