Who can request the TD Home Equity FlexLine (HELOC)?

The process application for TD Home Equity FlexLine (HELOC) it’s simple and transparent. By owning a home in Canada and having considerable equity in your property, you can quickly qualify for the TD Home Equity FlexLine.

A good credit history and stable income will strengthen your application, increasing your chances of approval.

Requirements to acquire

✅ Must have a residence in Canada

✅ Must have sufficient equity in the property

✅ A good credit history is essential for approval

✅ Proof of stable income to support monthly payments

A tip for you!

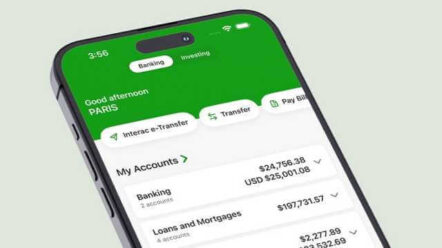

Manage your loan with ease through TD’s digital platforms, ensuring quick and convenient access to your credit. With the security provided by using your home’s equity as collateral, you can have peace of mind knowing your finances are protected.

Don’t miss the opportunity to unleash the potential of your assets. Apply for the TD Home Equity FlexLine today and enjoy the benefits of a line of credit designed for your needs.

The fees interest rates are variable and change with the TD Prime base rate.

How to request TD Home Equity FlexLine (HELOC)?

Access the TD website, see all the information and ask an employee to call you and answer your questions or make an appointment. The TD team is ready to help.

Don’t miss the opportunity to unleash the potential of your assets. Apply for the TD Home Equity FlexLine today and enjoy the benefits of a line of credit designed for your needs. Contact a TD representative to start your application and discover how this product can transform your personal finances.