Who can request a mortgage loan from TD Personal Banking?

You can apply for a TD mortgage loan, which anyone looking to finance a new purchase, refinance or change of mortgage to TD, as long as they meet the basic requirements.

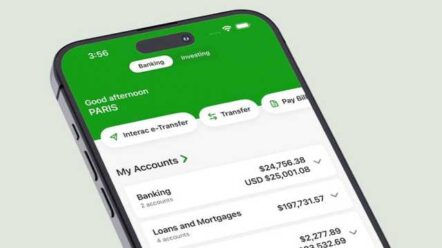

Take advantage of the chance to get a mortgage with unique financial benefits at TD Bank. Earn up to CAD 4,100 bonus and enjoy the flexibility and support that only a trusted bank can offer.

Requirements to acquire a mortgage from TD Personal Banking

✅ Be a Canadian resident or permanent immigrant

✅ Have a good credit history

✅ Have a minimum down payment of 5% of the property value

✅ Provide documentation supporting income and employment

A tip for you!

Whether you’re looking for a new mortgage, financing, or want to transfer your current mortgage, TD Bank offers full support through dedicated experts who can help you find the best option. Scheduling an appointment or requesting a call is simple, allowing you to receive personalized advice and have all your questions answered effectively.

With the terms and benefits offered by TD Bank, now is the ideal time to consider a TD Mortgage Loan and turn your dream of purchasing or improving your home into a reality.

Set up automatic payments as soon as possible to ensure you receive bonus cash directly into your account.

TD Personal Banking Mortgage Rates?

Fees vary depending on the principal amount and the applicant’s financial situation.

How to apply for a mortgage loan from TD Personal Banking?

Sign up and finance your mortgage by choosing a TD or FlexLine TD Home Equity mortgage with a term installment through October 31, 2024. Configure pre-authorized debit payments for your mortgage or FlexLine. Bonus cash will be deposited directly into your account within 60 days of funding or installment setup.

Contact a TD specialist today and take the first step towards achieving your dream home. Don’t let this opportunity pass you by – start your journey with TD Bank now!