Documents required for application of apital Now Personal Loan

Before learning how to apply for the Capital Now Personal Loan, check if you are eligible.

✔️ Proof of identity

✔️Know how to request XX Proof of Address

✔️Proof of age

✔️Bank statement of last six months

✔️ Income Tax Return or Form 16

✔️Salary slip of last three months (for salaried)

✔️ Proof of Income / Financial Statements (for self-employed)

Rates applied on Capital Now Personal Loan

The interest rate for Capital Now Personal Loan starts from 10.25% per annum with compound interest reducing on the monthly outstanding balance. The processing fee for the loan can be up to 2.0% of the loan amount. Keep reading to learn how to apply for the Capital Now Personal Loan.

The loan tenure ranges from one year to five years, providing flexibility to borrowers. Additionally, pre-closure charges are applicable after six months of availing the loan, which allows partial or full repayment of the outstanding principal amount with a 5% charge on the remaining principal amount. Notably, no guarantor is required to avail this loan, making the application process simple for borrowers.

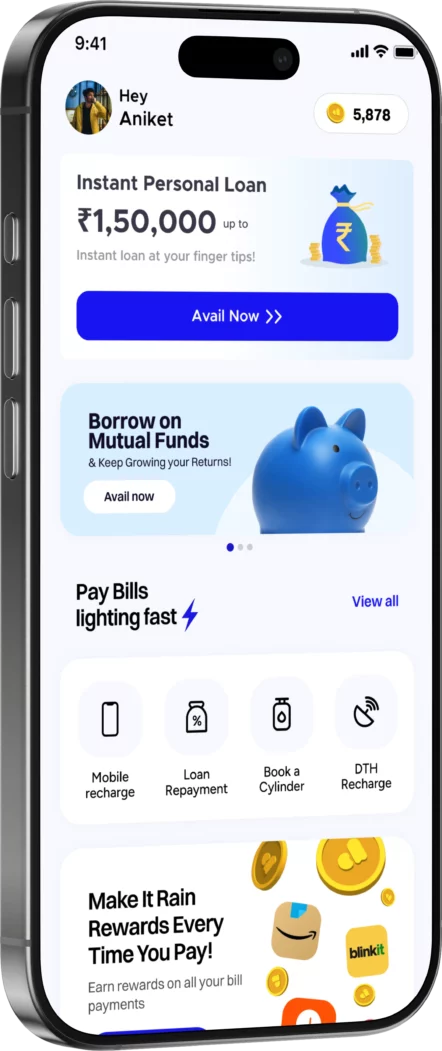

How to Apply for the Capital Now Personal Loan?

This is the step by step of how to apply for the Capital Now Personal Loan.

✔️Step 1: Register with your Facebook or Google account

-> Sign in with your Facebook or Google account

-> Crosscheck your name, contact number and email ID

✔️: Check Eligibility

-> Enter your PAN number

> After that, provide basic details like date of birth, nationality and monthly salary

-> Upload KYC documents

-> Confirm your personal information

-> Provide reference contact details

✔️Step 3: Provide transaction details

-> Provide your bank account details (Account Number and IFSC Code)

-> Turn on e-sign from mobile

✔️Step 4: Get the loan in your bank account

-> Loan will be credited to your bank account

-> Pay monthly payments on time for higher credit limit