What are the main Benefits of the Earnin Cash Out?

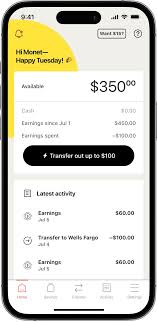

The benefits of the Earnin Cash Out go far beyond simply getting early access to your paycheck. One of its standout advantages is the complete absence of interest rates and hidden fees — a major relief compared to traditional payday loans or credit cards. Instead of borrowing money, users simply access wages they’ve already earned, up to $150 per day and $750 per pay period.

There are no credit checks, making it accessible to a wide range of working professionals, even those with low or no credit history. Additionally, for those who need money urgently, the Lightning Speed option allows funds to be transferred instantly to your bank account for a small fee, while standard transfers remain free and take just a few days.

Another one of the core benefits of the Earnin Cash Out is its voluntary tipping model, where users can choose how much to tip — even as little as $0 — reinforcing the platform’s mission to provide ethical and flexible financial support without creating long-term debt.

What is the Earnin Cash Out?

The Earnin Cash Out is a flexible and fee-free way to access money you’ve already earned — before your paycheck is deposited. Instead of waiting until payday, users can withdraw a portion of their earnings in real time. This provides immediate relief for unexpected expenses, bills, or emergencies.

It’s not a traditional loan. There’s no interest, no debt accumulation, and no credit score impact. The app connects to your bank and tracks your hours worked, allowing you to “cash out” what’s already yours. The benefits of the Earnin Cash Out go far beyond convenience — it promotes financial independence without relying on credit cards or payday loans.

Earnin has become especially popular among workers in retail, healthcare, food service, and gig platforms, where income may fluctuate and financial flexibility is critical.

Who can use Earnin Cash Out?

To access the benefits of the Earnin Cash Out, you must meet a few simple eligibility requirements:

✔️ Receive regular paychecks via direct deposit

✔️ Earn a minimum of $320 per pay period

✔️ Have a checking account with at least 30 days of transaction history

✔️ Work with a fixed schedule or log hours using an online timesheet

✔️ Be located in the United States

The simplicity of these requirements means that many part-time, full-time, and gig economy workers can qualify. You don’t need perfect credit or a long employment history to get started.

What fees are associated with Earnin Cash Out?

One of the most important benefits of the Earnin Cash Out is that there are no mandatory fees or interest charges. Instead, users are invited to leave a voluntary tip — even if it’s $0.

For those needing instant access, Earnin offers the Lightning Speed feature, which instantly delivers your cash for a small fee. The Lightning Speed fee varies depending on your bank and ranges from $2.99 to $5.99. Standard transfers remain completely free and typically take between 1 to 3 business days.

There are no setup costs, no late fees, and no penalties. This pricing model promotes transparency and gives users complete financial control.

A word of advice for you!

The benefits of the Earnin Cash Out are clear — but using this feature wisely is just as important. As a financial tool, it can be incredibly helpful during unexpected emergencies or when your expenses don’t align with your payday. However, it’s essential not to rely on early wage access as a permanent solution.

If you find yourself consistently needing to cash out early, consider reassessing your financial habits. Build a basic budget, track your spending, and explore ways to save for an emergency fund. Small steps like cutting a subscription or cooking at home can help reduce financial stress in the long run.

Remember, Earnin Cash Out is a tool — not a crutch. Used responsibly, it can support short-term needs without compromising your long-term financial health.

Click here to unlock the full benefits of the Earnin Cash Out!

Now that you understand the key benefits of the Earnin Cash Out, why not experience it for yourself? Whether you’re dealing with surprise bills or simply want to break free from the rigid payday cycle, Earnin can help you stay in control of your money.

Click the button below to visit Earnin’s official site and start the quick, secure application process. It only takes a few minutes to set up — and you could access your money today.