How Does a Student Loan Work?

A student loan is a type of credit designed to finance the education of students in undergraduate, graduate, or specialized programs. With the Sofi Student Loan, students can cover tuition fees and additional costs like books and housing. The financed amount is paid in monthly installments, which include the principal amount and applicable interest.

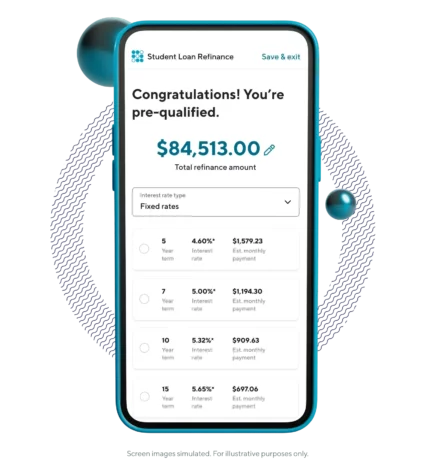

Sofi offers flexible payment options, allowing students to begin paying installments while still in school or after graduation. Interest rates can be fixed or variable, and students have the freedom to choose the plan that best suits their budget and financial situation.

What Are the Requirements for This Loan?

✔️ Be a U.S. citizen or permanent resident

✔️ Be over 18 years old

✔️ Be enrolled in an accredited educational institution

✔️ Have a solid credit history or a co-signer with good credit

What Documents Are Needed to Apply for the Loan?

✔️ Valid ID (driver’s license or passport)

✔️ Proof of enrollment in an educational institution

✔️ Proof of income from the applicant or co-signer (tax returns or pay stubs)

✔️ Information about the course and program duration

What Are the Fees Charged?

The Sofi Student Loan does not charge opening fees, representing significant savings. Interest rates vary according to the student’s profile and loan type, with the choice between fixed or variable rates. Additionally, Sofi does not charge penalties for early payments, ensuring more flexibility in managing financing.

A Tip for You!

Applying for a student loan can open doors to personal and professional growth. However, it’s essential to assess your ability to pay before making this decision. By committing to a loan, students should plan their monthly budget, knowing they’ll need to repay the debt after graduation.

Maintaining good financial control and avoiding other debt accumulation during studies is crucial. Consider setting up an emergency fund for unexpected events, ensuring you’re prepared to meet financial obligations even in challenging situations.

Although the Sofi Student Loan offers competitive terms, comparing other loan options is always recommended. Make sure the plan you choose best meets your long-term needs and allows you to focus on your studies with peace of mind.

Apply Now for the Sofi Student Loan!

If you’re ready to fund your education with the Sofi Student Loan, don’t wait! Sofi offers a fully online application process, where you can simulate the financing amount and get pre-approval in minutes.

Click the button below to visit Sofi’s official website and start the application process to secure funding for your studies.